New Advice For Choosing A Trade RSI Divergence

Wiki Article

Trade RSI Divergence Automatically Via Cleo.Finance!

Divergence occurs when the direction of the prices of an asset and of a technical indicators move in different directions. Divergence between price, momentum indicators like the RSI/MACD could be helpful in identifying potential modifications to the price of an asset. This is the reason it is a cornerstone for many trading strategies. We are happy to announce that you now have the ability to use divergence to design closing and open conditions for your trading strategy by using cleo.finance. View the most popular backtesting strategies for more tips including forex backtesting, forex backtesting software, crypto trading, automated crypto trading, RSI divergence cheat sheet, trading platforms, crypto trading, crypto backtesting, crypto trading backtesting, best crypto trading platform and more.

There Are Four Major Types Of Divergences:

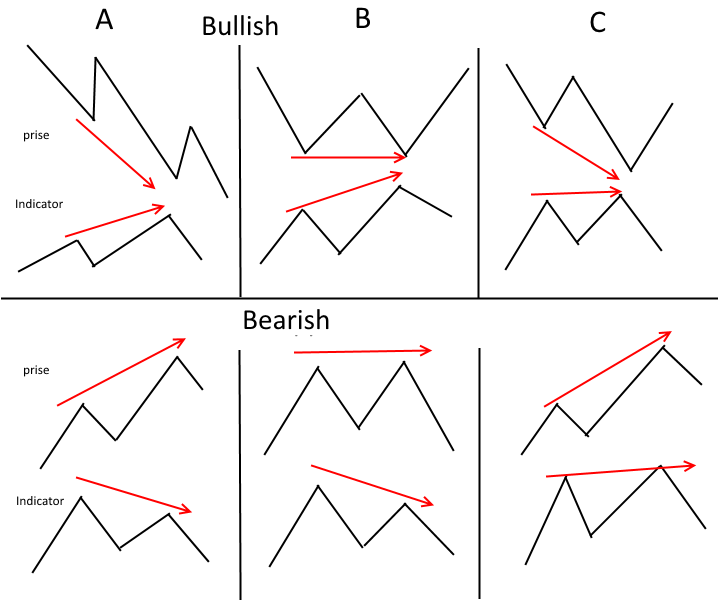

Bullish Divergence

The technical indicator is showing higher lows, while price prints lower lows. This signalizes a weakening momentum of a downtrend and a reversal to the upside is likely to occur.

Hidden Bullish Divergence

The price and the oscillator are making lower lows than the oscillator. Hidden bullish divergence is an indication that the uptrend continues. This can be seen at the tail of a price bounce or the retracement.

Hidden Bullish Divergence Explanation

Quick Notes: watching the troughs during an uptrend drawback, price moves initially up

Bearish Divergence

The price has been making higher highs, while the technical indicator shows lower levels. This suggests that momentum is declining to the upside, and the reverse is possible.

Bearish Divergence Explanation

Quick Notes: if you are watching the highs in an uptrend the indicator first moves downwards

Hidden Bearish Divergence

The oscillator shows higher levels than the price, but the price is making lower highs. An unnoticed bearish divergence could indicate that the downtrend will peRSIst and can be seen at the end of a price pullback (retracement upwards).

Hidden Bearish Divergence Explanation

Quick Notes - Prices drop initially when a peak is observed in a downtrend.

Regular divergences provide a reversal signal

The frequent occurrence of divergences may signal that a trend is likely to reverse. They indicate that the trend is weakening but is still strong . They provide an early indication of potential direction shifts. The presence of divergences can be effective entry triggers. Have a look at the most popular divergence trading forex for site advice including crypto backtesting, cryptocurrency trading, backtesting platform, automated cryptocurrency trading, forex backtesting, automated forex trading, bot for crypto trading, backtesting trading strategies, forex backtesting software, crypto backtesting and more.

Hidden Divergences Signal Trend Continuation

Hidden divergences, on other hand are continuation signals that can often be found in the middle or at the conclusion of the trend. These signals could indicate that the current trend could continue after the pullback. Traders frequently use hidden divergences in order to join in the trend following a pullback.

Validity Of The Divergence

Divergence is a good choice when used in conjunction in conjunction with a momentum indicator like RSI or the Awesome oscillator. These indicators are focused on the current momentum, so trying to locate divergence over 100 candles is not feasible. However changing the period of the indicator affects the look-back range of an actual divergence. Be cautious when deciding the legitimacy of the divergence. Any divergences could not be valid.

Available Divergences in cleo.finance:

Bullish Divergence

Bearish Divergence

Hidden Bullish Divergence:- Read the best best crypto trading platform for blog info including forex backtesting software free, bot for crypto trading, best trading platform, automated trading bot, crypto trading backtesting, backtesting platform, automated trading bot, automated trading software, best trading platform, forex backtest softwareand you can compare those divergences between two points:

Price With An Oscillator Indicator

A oscillator indicator that is paired with an oscillator indicator price of any asset with the price of any other asset.

Here is a guide on how you can use diveRSIons on cleo.finance builders

Hidden Bullish Divergence cleo.finance - Open conditions for building

Customizable Parameters

All divergences can be further customized by traders with the help of four parameters that can be edited.

Lookback Range (Period)

This parameter controls how far back the strategy should search for divergence. The default value is 60 which is "Look for the divergence anyplace within the 60 bar interval that has passed"

Min. Distance Between Peaks/Troughs (Pivot Lookback Left)

This parameter indicates how many candles must be lit to both sides of the pivot point in order to ensure that it's where it is.

Confirmation bars (Pivot Lookback Right)

This parameter defines how many bars on the right side are required to ensure that the pivot point is located. Check out the most popular automated forex trading for more tips including best forex trading platform, best forex trading platform, forex tester, forex backtesting software free, backtesting strategies, automated trading, automated trading software, software for automated trading, bot for crypto trading, automated trading and more.

Timeframe

You may define here the timeframe during the period that the divergence needs to be observed. This timeframe can be different from the execution timeframe of the strategy.Customizable parameter settings of divergences on cleo.finance

Differentgenes parameters settings in cleo.finance

The settings for the pivot point determine the point at which each divergence reaches its peak. You can keep the default settings to create an upward divergence.

Lookback Band (bars), 60

Min. Distance between troughs is (left) = 1.

Confirmation bars (right), = 3

This setting means that both troughs of the divergence should be the lowest point within the 5 bars closest to them (lower than 1 bar on the left, and 3 bars to the right). This is true for both troughs in the 60-day lookback interval. The nearest pivot point can confirm that the divergence occurred 3 bars after the divergence was first noticed.

Available Divergencies In Cleo.Finance

The most popular uses of RSI divergence are MACD diversgence. But be assured that other oscillators can also be studied and traded live using the trading automation platform cleo.finance. Follow the top divergence trading forex for more advice including backtester, automated trading software, backtester, trading with divergence, trading platform crypto, automated cryptocurrency trading, bot for crypto trading, trading divergences, crypto backtesting, forex backtesting software free and more.

In Summary

Divergences may help traders to add an important tool in their arsenal. However they should not be employed without cautious planning. Keep these things in mind and traders can be prepared to utilize divergences to their advantage in making better trading decisions. It is crucial to approach divergences with a disciplined and strategic mindset. When you combine them with other types of analytical and technical like Support and Resistance Lines, Fib Retracements and Smart Money Concepts increase the likelihood of the divergence being valid. Check out our Risk Management Guides on Stop loss location and size. You can create optimal divergence trading strategies immediately using more than 55 technical indicators and price movement. The cleo.finance platform is continuously getting better. If you have a request for an indicator or data point, let us know.